Anyone who is considering selling their own product on Amazon needs to know how to determine their gross profit margin. Many sellers who have rushed to get their product online have made quick calculations only to find out later that their product was making next to nothing. All that work for an 8% profit margin.

And one of the most important pieces of overhead costs is the Amazon seller fees. Because Amazon is allowing you to access their sales platform, they’ll be taking a cut from every unit that you sell. When you consider the traffic numbers on Amazon, that’s a fair deal.

But many sellers get confused when they try to sort through all of the content Amazon offers on seller fees. So in order to make sure you’re calculating your overhead correctly, we’re going to break down Amazon seller fees into easy steps. By the end of this article, you’ll be able to confidently determine your total profit margin by integrating all of Amazon’s fees.

1. Amazon Fees for Selling on Amazon

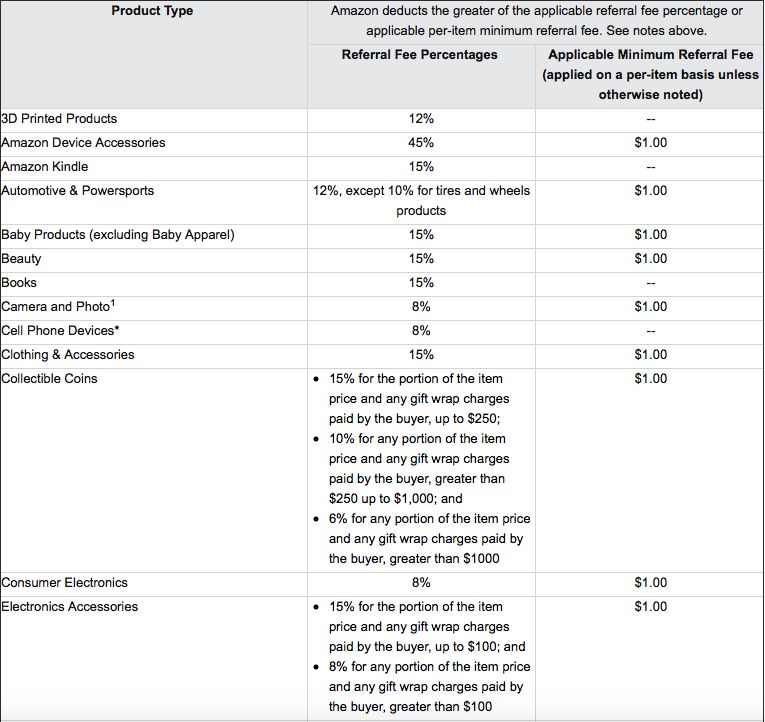

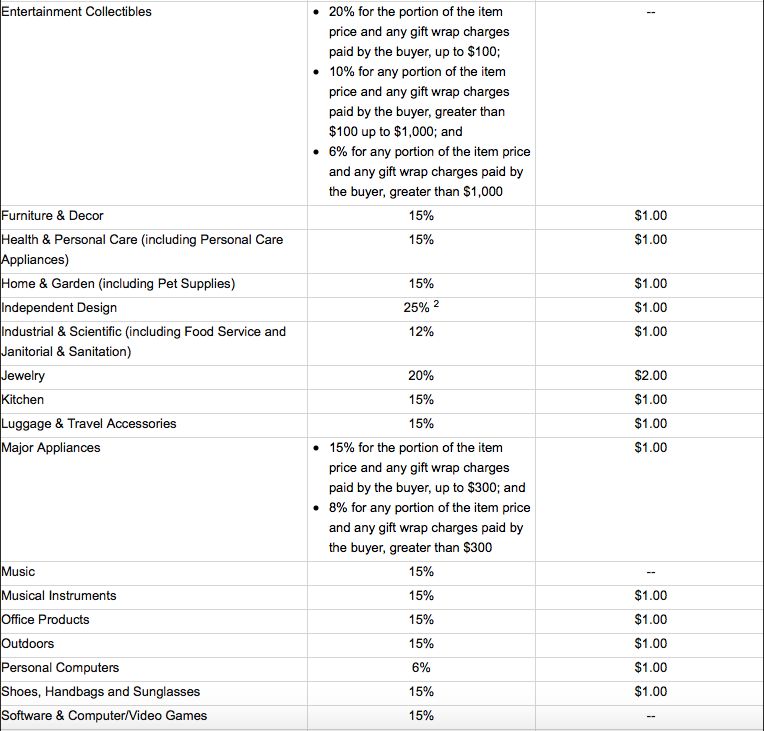

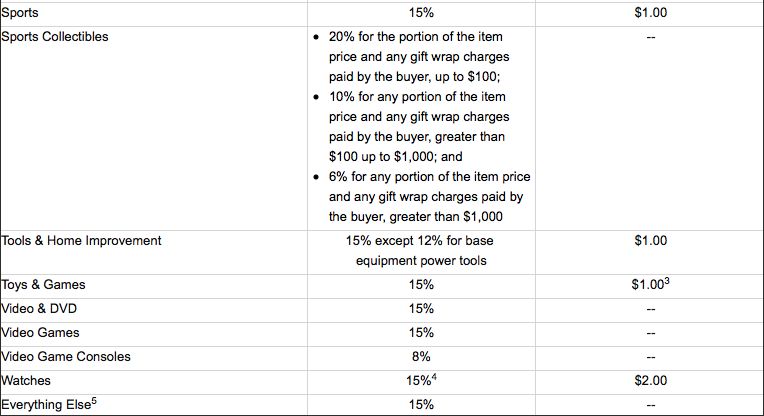

Amazon divides each of their products into 38 categories (and one category entitled “Everything Else”). Each of these categories are handled differently by Amazon, taking either a referral fee percentage of the product’s sale price or a minimum referral fee (whichever fee is more).

Here’s the Amazon chart, showing the various categories in which your product will be placed and the fees related to each:

Note: These values may change. See this Seller Central page for up to date info.

So for example, if you sold a product in the kitchen category for $20, you would be charged a 15% referral fee ($3) because 15% of $20 is more than the $1 minimum referral fee. But if you sold a kitchen product for $3, you’d be charge a $1 minimum referral fee because the minimum referral fee is more than 15% of $3 ($0.45).

However, the minimum referral fee isn’t applicable to all categories. Some categories only require a referral percentage regardless of the sale price (i.e. Video Games and Consoles)

Typically, unless your price point is around $5 or $6, Amazon will be taking the referral percentage out of your sales price.

2. Amazon Fees for Using Fulfillment by Amazon

My recommendation for anyone just starting their Amazon business is to use Fulfillment by Amazon. Of course, you could always find another drop shipper or ship the products yourself, but outsourcing your shipping to Amazon is a great way to free you up to concentrate on other bigger tasks in your business.

But whether you use Amazon FBA or a drop shipper, there will be a fee involved. The difference is that Amazon will remove your FBA fee directly from your sales and doesn’t require you to pay a separate bill. Every two weeks, you’ll be given your sales profit with shipping and Amazon seller fees already taken out.

For the purposes of this article, I’m only giving you the FBA fees for the United States. If you’re selling on another Amazon platform, there are different FBA fees which you can find on their own website (i.e. amazon.ca).

Is your product a media item or a non-media item?

Media items only include books, music, videos, video games and consoles, DVDs, and software and computer games. If you’re product is not one of those items, it is a non-media item.

Is your product standard size or oversized?

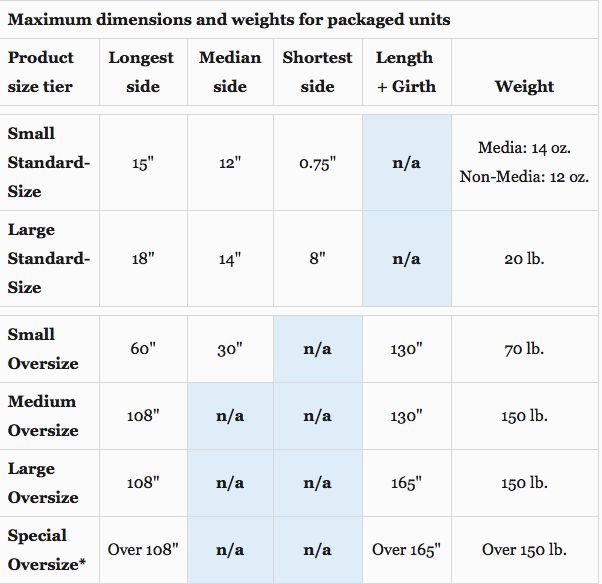

If your product weighs 20 lbs. or less, 18” or less on its longest side, 14” or less on its median side, and 8” or less on its shortest side, it will be considered standard size. Any product that exceeds those dimensions will be considered Oversize.

Is your product small standard size or large standard size?

But to help you determine whether your product is small standard or large standard, Amazon offers this chart:

Remember, if your product exceeds any measurement within the small standard row, it will be considered a large standard.

For every product, there are three primary fees associated with using FBA.

- Order Handling ($0 for media / $1 p/unit for non-media)

- Pick and Pack ($1.06 p/unit)

- Weight Handling (dependent on weight and size)

To calculate your weight handling fees, determine whether your product is a small or large standard size, then apply that information to this chart:

| Item Size | Media | Non-Media |

|

Small Standard (1 lb. or less) |

$0.50 |

$0.50 |

|

Large Standard (1 lb. or less) |

$0.85 |

$0.96 |

|

Large Standard (1 lb. to 2 lbs.) |

$1.24 |

$1.96 |

|

Large Standard (over 2 lbs.) |

$1.24+ $0.41/lb. above |

$1.95 + $0.39/lb. above |

Keep in mind that these fees are based on your outbound shipping weight which includes the total weight of both the product and the packaging rounded to the nearest pound. If you want more details on how the outbound shipping weight is determined, go to this section of Amazon’s fee guidelines and click on the How to Calculate Outbound Shipping Weight link.

Applying what we learned

So let’s put this into real life.

You’re selling a kitchen product on Amazon for $20 and using FBA.

First, you need to determine your referral percentage fee. Looking at the chart, you know that Amazon deducts 15% from your sale price just because you’re selling on their platform.

Sale Price ($20) - Referral Percentage ($3 [15%]) = $17

Secondly, you need to determine whether your product is media or non-media. Since your product is a kitchen utensil, you know that it’s non-media. Therefore, you can already know that both an order handling fee and a pick and pack fee will be applied.

$17 - Order Handling Fee ($1) - Pick and Pack Fee ($1.06) = $14.94

And lastly, you’ll need to determine the weight of your product. Let’s say that due to it’s height, it is considered a large standard size, and it weighs 1 lb. Using the chart above, we can calculate the weight handling fee to be $0.96.

$14.94 - Weight Handling Fee ($0.96) = $13.98

Now you have an actual picture of what your total Amazon fees will be, and this number can be used to calculate your overhead. Regardless of your product, you should always use this formula to calculate your Amazon fees:

Amazon profit = Sale Price - Referral Percentage - Order Handling - Pick and Pack - Weight Handling

Conclusion

Before you ever launch your product, it’s essential that you determine your total profit margin by deducting your COGS (cost of goods sold) and overhead costs from your sale price. Only then can you know that your business has long-term potential. One of the most essential of these overhead costs is your Amazon fees.

Whenever you’re first starting your Amazon business, the pages of information provided to calculate your Amazon fees can be overwhelming and confusing. Hopefully, this article will help you walk through this process a little more easily. Use the formula above, then start determining whether your price point is high enough or not.

Making cost effective decisions is incredibly important to any ecommerce business. It's also important to save money where you can on marketing and a great way to do that is with Salesbacker so that you can get more product reviews from your every day customers without having to spend a lot of extra money on product promotions. Try Salesbacker for free here. It will take you less than 7 minutes to get started (yes we counted).